fsa health care contribution

The Health Care Flexible Spending Account HCFSA is simple to use. Each spouse in the household may contribute up to the limit.

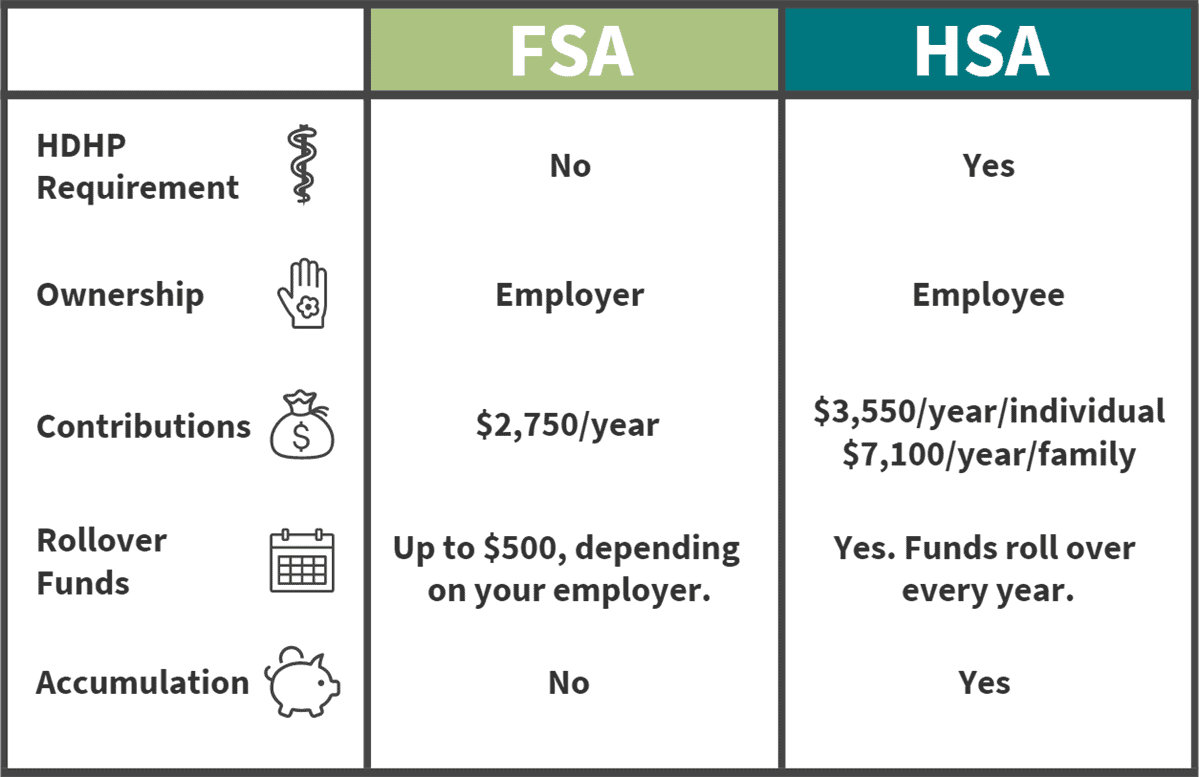

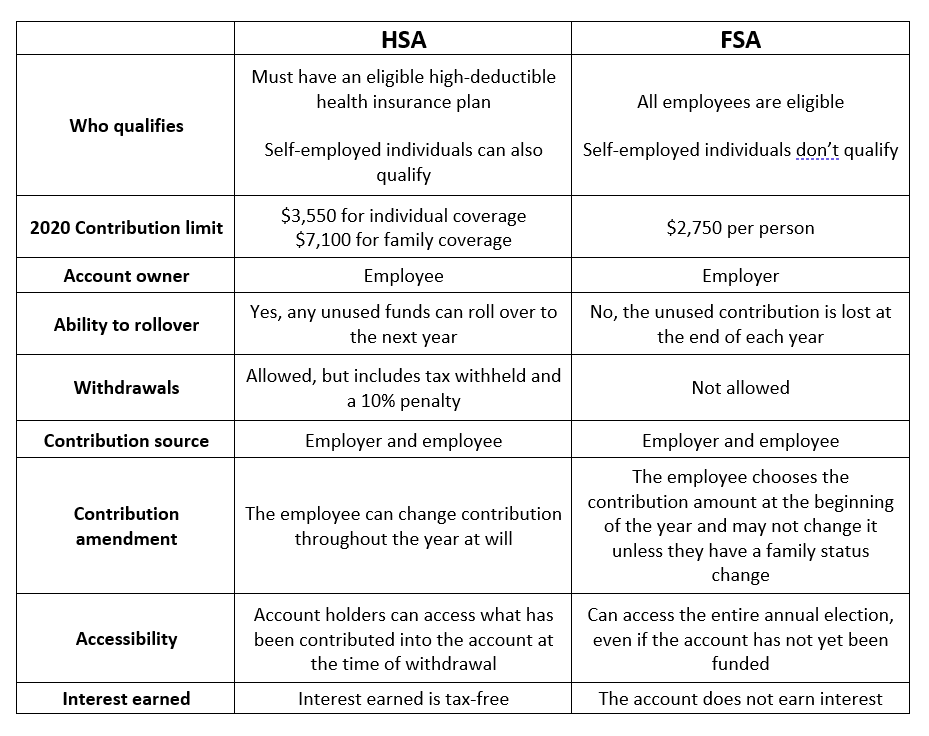

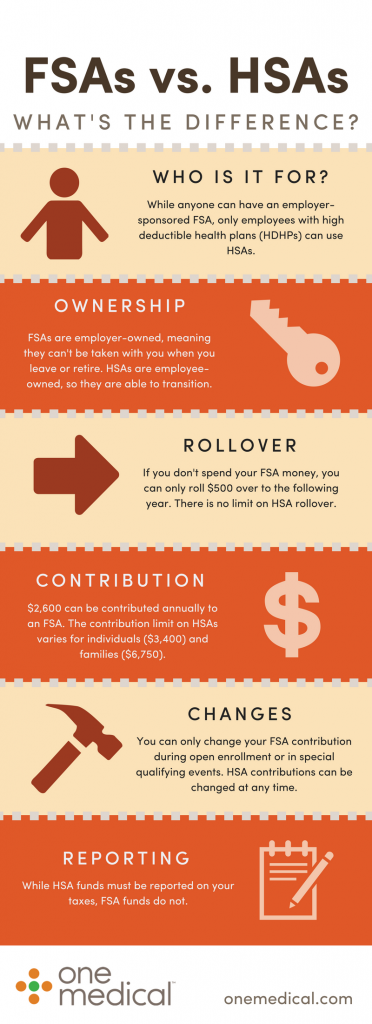

What S The Difference Between An Fsa And An Hsa Aspen Wealth Management

If youre married and both you and your spouse have an FSA you can contribute 2750 to each account.

. In general an FSA carryover only applies to health care FSAs. As part of the Health Care Reform Act the maximum contribution amount is 2500. The limit is per person.

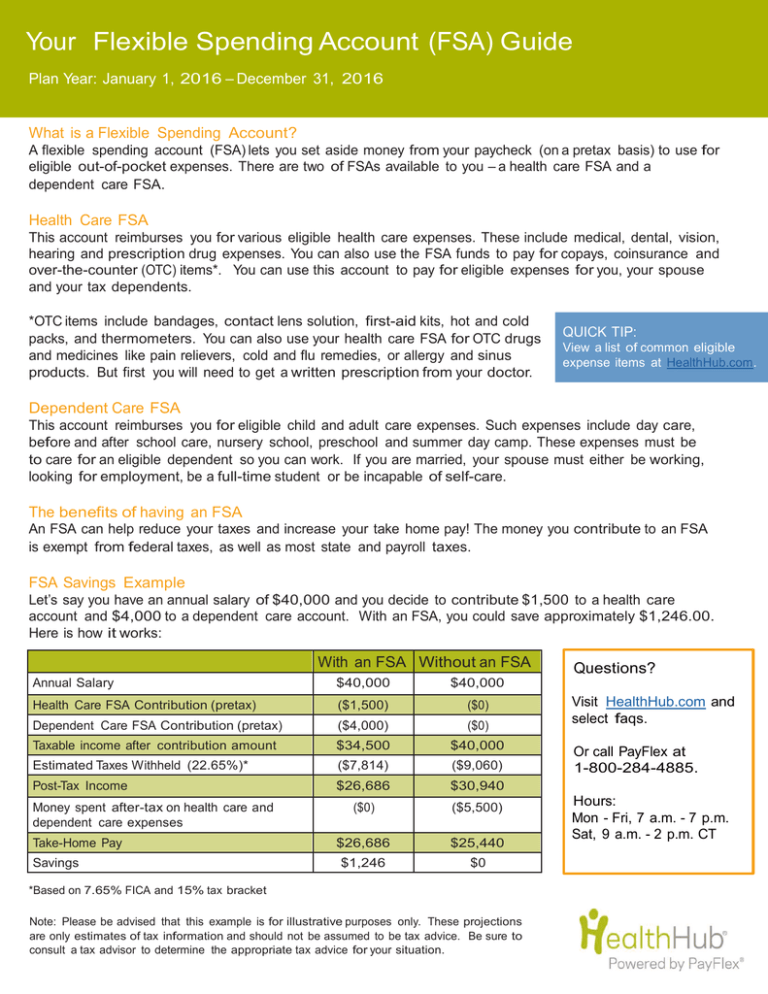

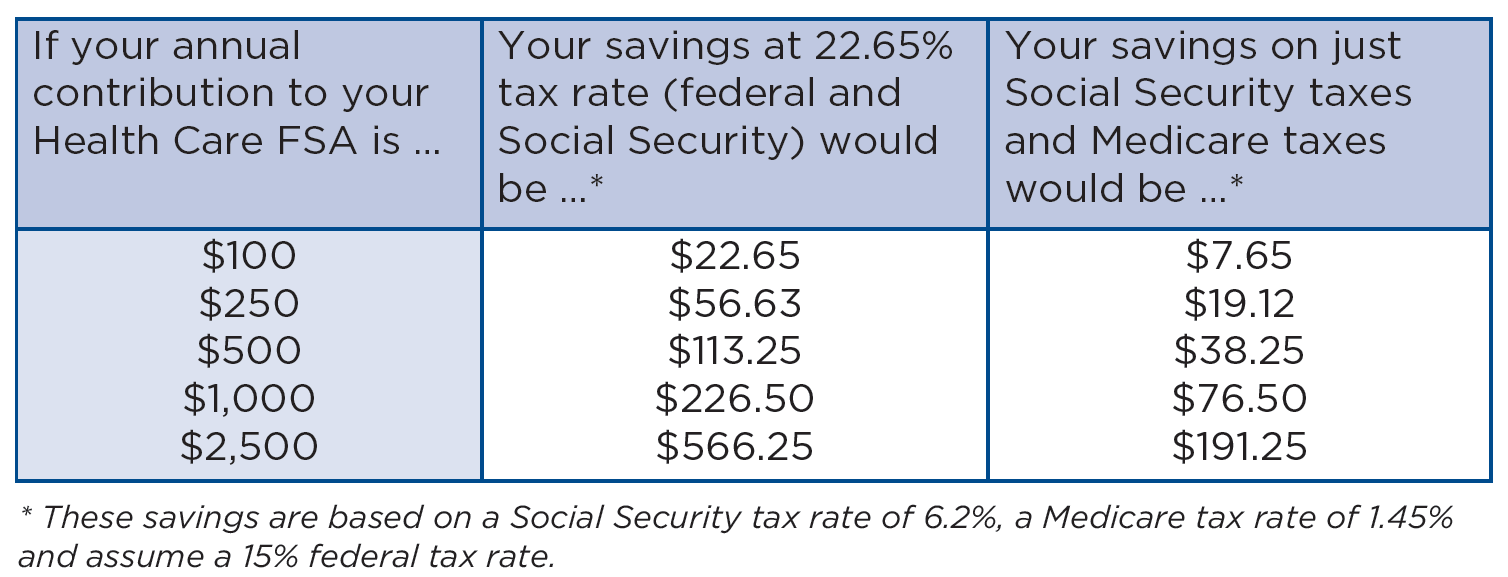

This means youll save an amount equal to the taxes you would have paid on the money you set aside. Elevate your health benefits. Get a free demo.

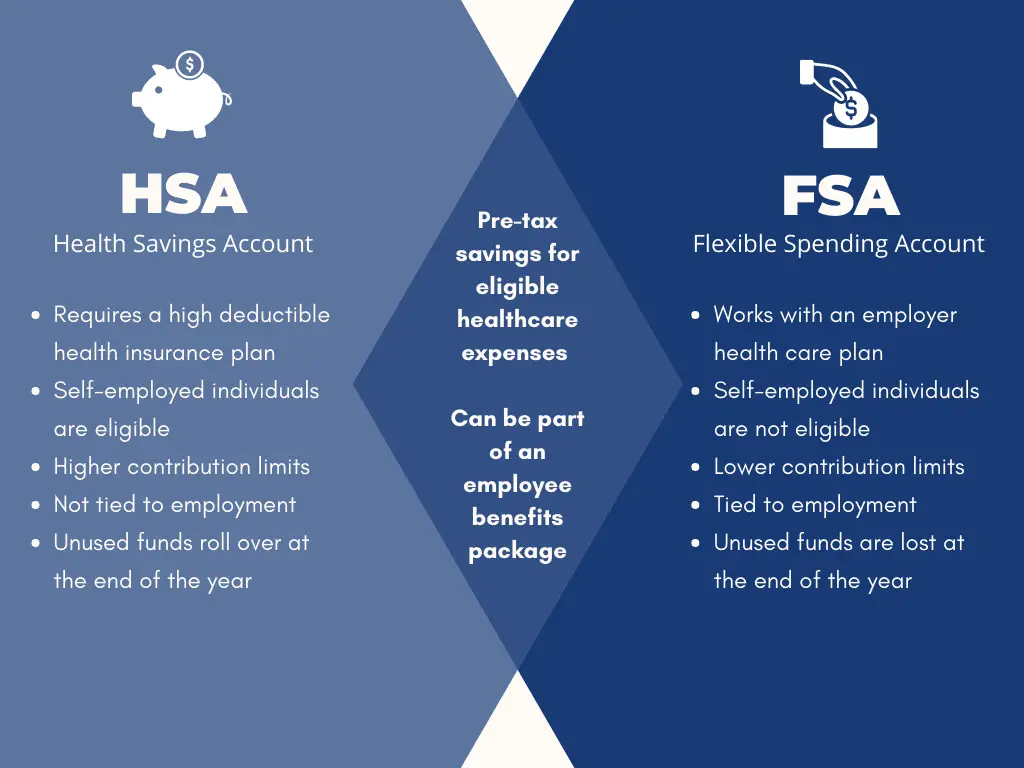

With health care Flexible Spending Accounts you can save on everyday items like contact lenses sunscreen and bandages. Your employer may elect a lower contribution limit. An FSA is not a savings account.

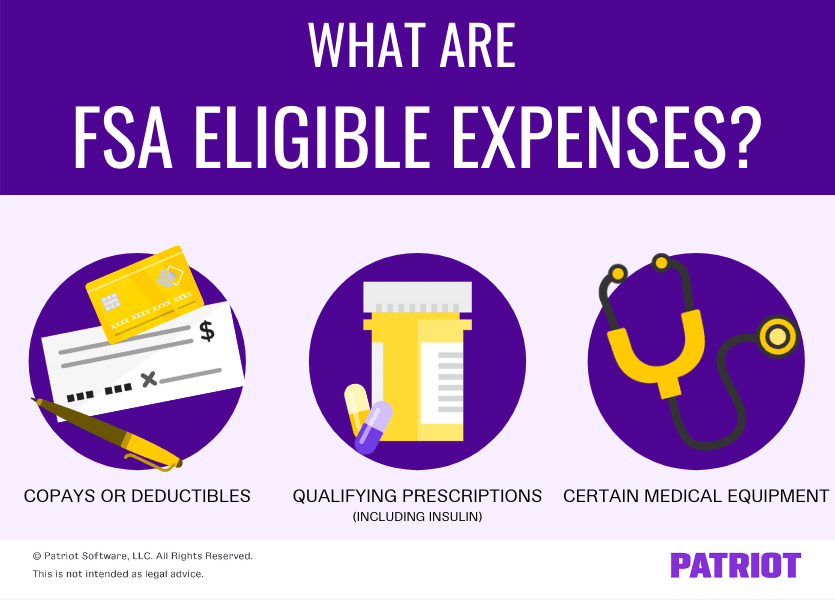

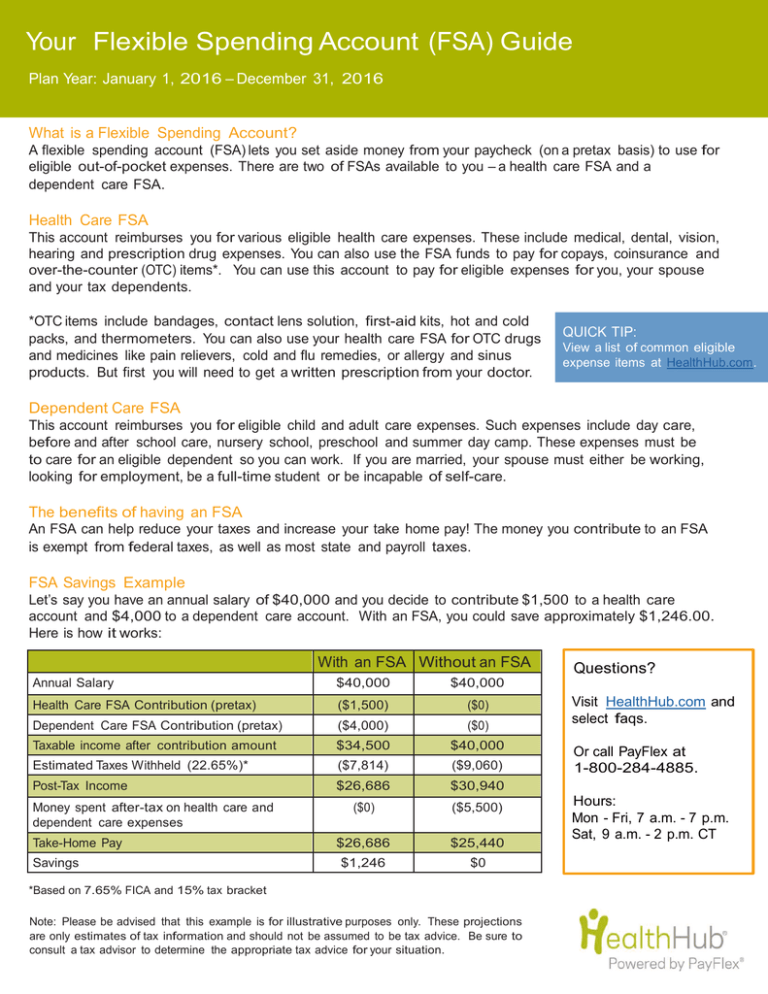

Heres how a health and medical expense FSA works. The maximum contribution amount for a dependent care FSA depends on your tax filing status. Cover deductibles co-pays dental vision more.

Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. By participating you choose to contribute a set amount to your. Contributing to an FSA allows you to reduce your taxable income as well as save on healthcare or dependent care costs since you are paying for these expenses in pretax dollars.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Keep in mind you may carry over up to 57000 remaining in your account from one plan year to the next. Employers may make contributions to your FSA but.

It remains at 5000 per household or 2500 if married filing separately. While there is an annual limit for employee Health FSA contributions 2850 in 2022 an employer may limit its employees to less than 2850. However COVID-19 relief legislation permitted carryover of unused DCFSA balances into the next plan year for plan years 2020 and 2021.

You dont pay taxes on this money. Or those high dollar expenses like surgery orthodontia and hearing aids. Single or married filing jointly you can contribute up to 5 000.

Taxable income after FSA contribution. Married filing separately you and your spouse can each contribute up to 2 500 each. Ad Where you pay once for IRS DOL required documents not every year.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. But heres the dealin order to use the calculator to accurately estimate your health care expenses you need to have an idea of what those expenses will be. As a result the IRS just recently announced the revised contribution limits for 2022.

Flexible Spending Account FSA Contributions You may contribute up to 5000 to the FSADependent Care and up to 2750 to the FSAHealth Care. Tax savings for employer and employee. Easy implementation and comprehensive employee education available 247.

Boston University will contribute to the FSA-Health Care if. You decide how much to put in an FSA up to a limit set by your employer. Pre-tax Health Care Contribution 1500 0 Pre-tax Dependent Care Contribution 4000 0 Taxable Income 18500 24000.

FSA contribution limits Account Minimum Contribution Amount Maximum Contribution Amount Health Care FSA 120 2550 Dependent Care FSA 120 5000 If you and your spouse each have a health care FSA you can each contribute 255000. FSAs only have one limit for individual. You can contribute up to a maximum of 285000 See contribution information to your Health Care FSA each year.

Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750. If you choose a filing status of. However it cant exceed the IRS limit 2750 in 2020.

You will be able to use up to 550 of monies remaining in your 2021 Health Care Spending Account HCSA towards eligible expenses incurred during the 2022 calendar year as long as you had an account as of. Health Care FSA contribution 2500 0. For plan year 2022 the maximum contribution amount that employees can make to their DCFSAs returns to 5000.

IRS Revenue Procedure 2019-44. The maximum annual amount you can contribute to a Child and Elderly Care FSA depends on which filing status you choose on your federal tax return. For 2021 you can contribute up to 2750 into your Healthcare FSA.

Annual contribution limits. When you enroll in the HCFSA you will receive a claims kit. However tax law rules may limit your FSADependent Care maxi-mum see the heading Maximum Contributions later in this section.

When enrolling please remember to elect your annual contribution amount. In other words you. For example if you earn 45000 per year and allocate 2500 to your FSA for health care expenses your estimated tax savings from your FSA is 812.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Dependent Care FSA contribution 2000 0. A Flexible Spending Account is an employee benefit plan established under IRC Section 125 that allows you to pay for everyday health care.

This is an increase of 100 from the 2021 contribution limits. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. If only one of you has an FSA you cannot double your contributions eg put 5500 into one account.

Ad Custom benefits solutions for your business needs. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Maximum salary deferral contribution.

An FSA is a tool that may help employees manage their health care budget. While the IRS 2021 pretax maximum for employee health FSA contributions is 2750 an employer may limit its employees to less. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

The employer also decides the provision for any unused Health FSA balance at the end of the year grace period partial roll-over or surrender. We are pleased to announce that the Health Care Spending Account HCSA and Dependent Care Advantage Account DCAA have adopted carryover. Health Flexible Spending Accounts includes limited-purpose FSAs 2020.

Employers set the maximum amount that you can contribute.

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Hsa And Fsa Accounts What You Need To Know Readers Com

![]()

Most Employees Don T Know Difference Between Fsa Hsa Survey Business Insurance

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Breaking Down Flexible Spending Accounts And Health Savings Accounts Notre Dame Fcu

What Do I Need To Know About Fsas And Hsas One Medical

Flexible Spending Account Nuesynergy

Flex Spending Accounts Hshs Benefits

Hra Vs Fsa See The Benefits Of Each Wex Inc

Hsa Vs Fsa What S The Difference All About Vision

Health Savings Account Thrive Credit Union

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

What Is An Fsa Definition Eligible Expenses More

Your Flexible Spending Account Fsa Guide

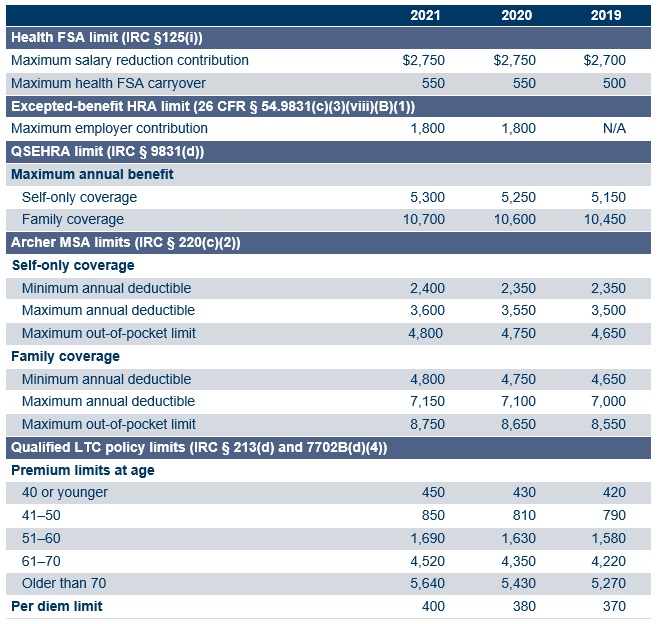

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer